Through land title data, we can tell you the specifics about a property and its history – everything from its financial background, to ownership records, to sales and valuation information.

Authoritative data to drive property intelligence.

Next Level Insights

Authoritative data to drive property intelligence.

Through land title data, we can tell you the specifics about a property and its history – everything from its financial background, to ownership records, to sales and valuation information.

Purpose-built solutions for:

Purpose-built solutions for:

What is PurView?

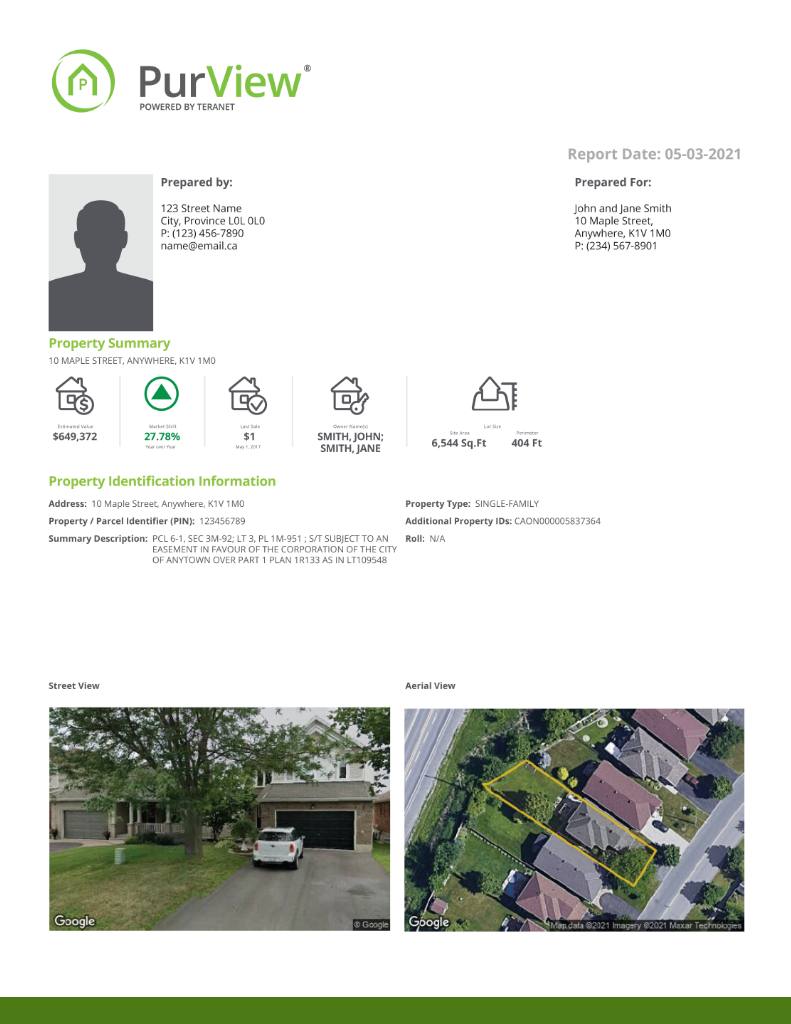

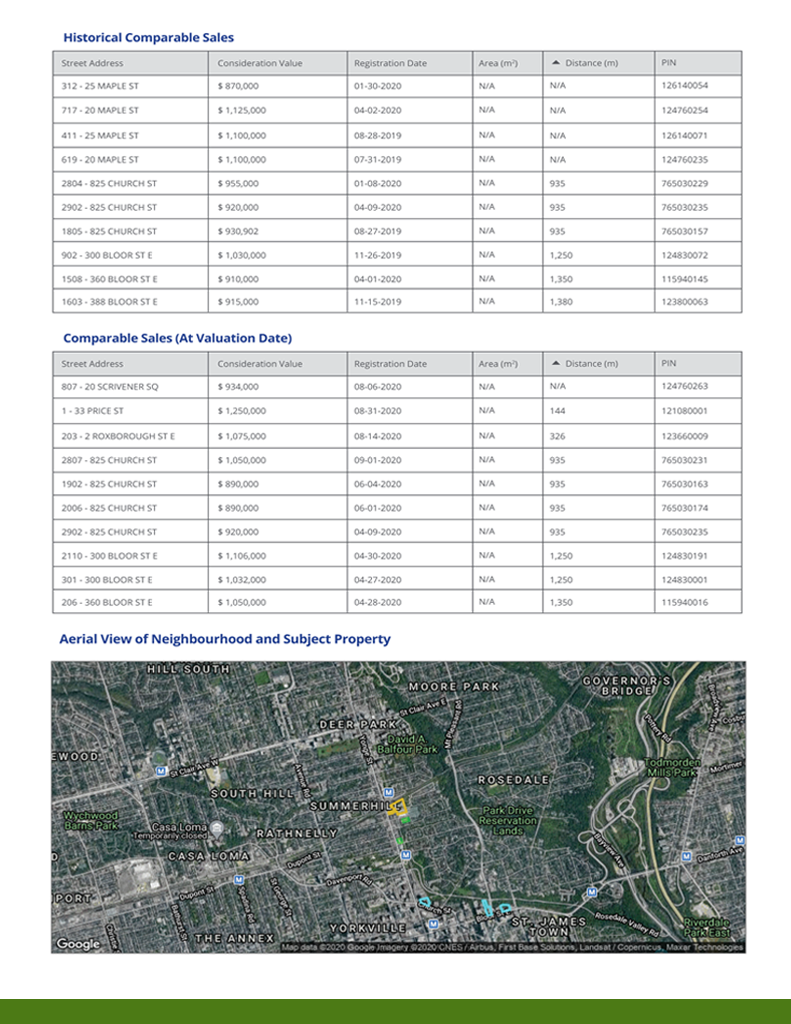

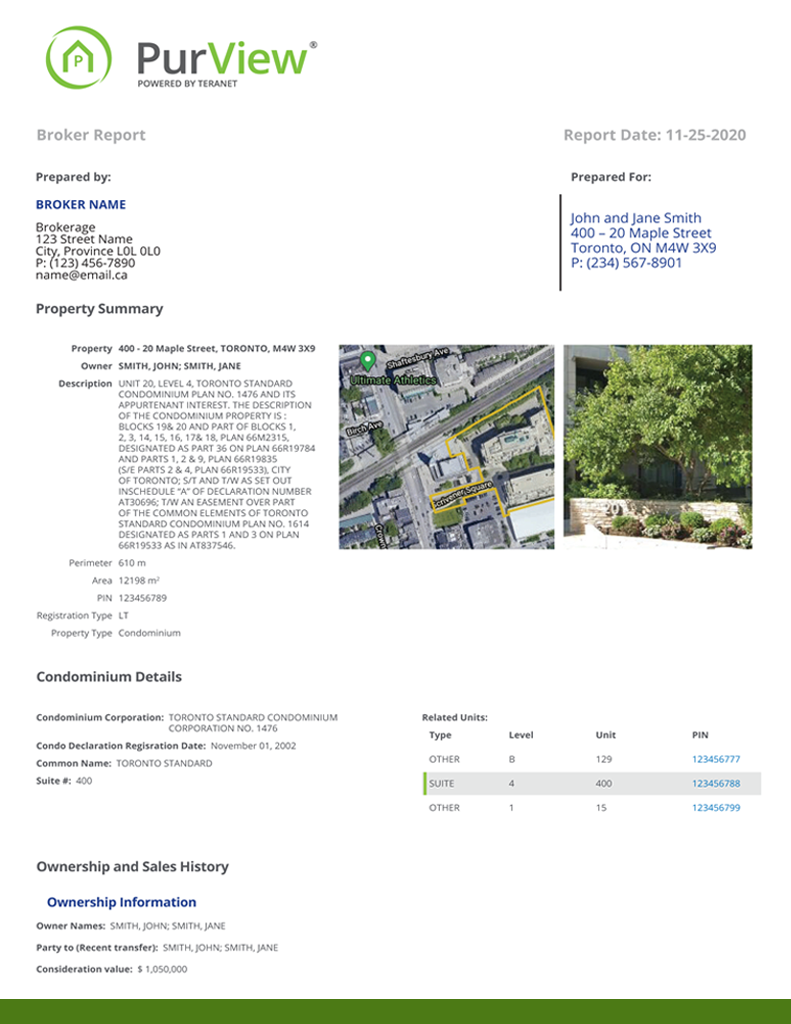

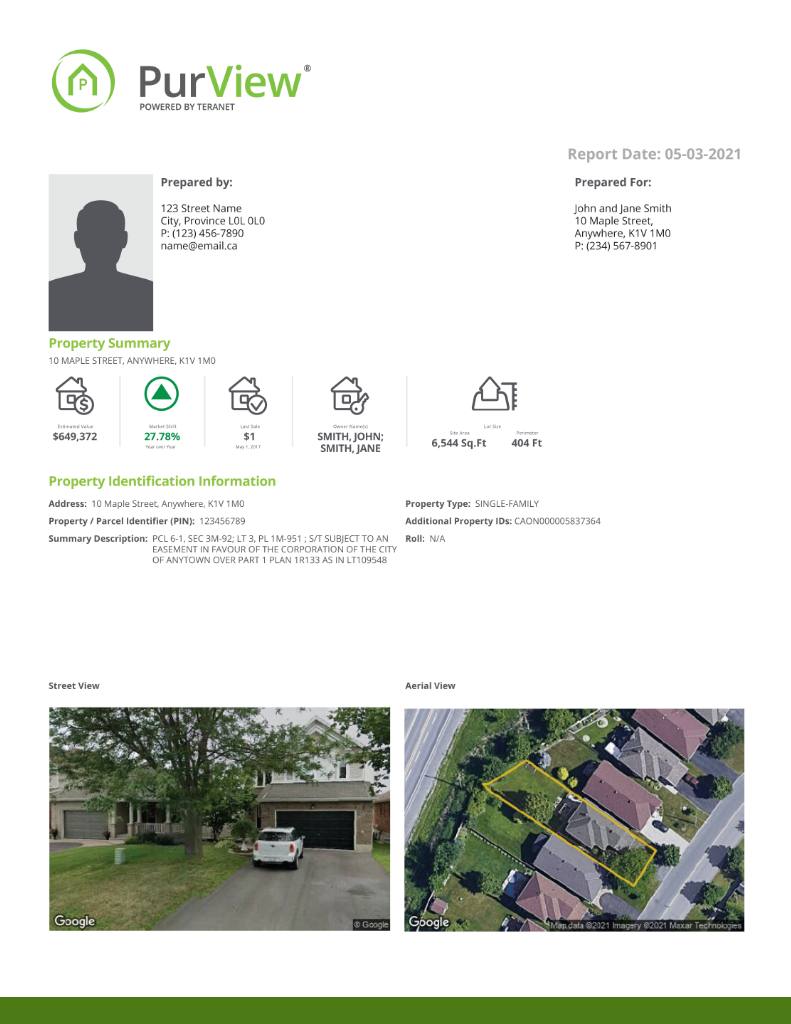

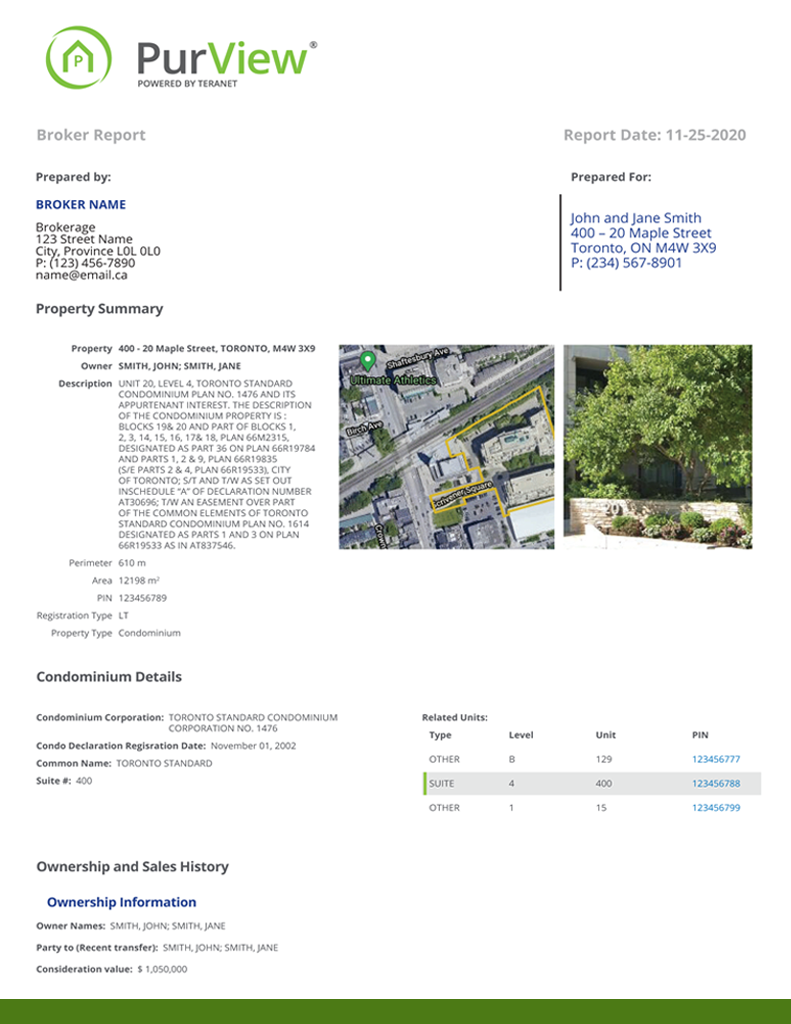

PurView provides authoritative property, neighbourhood and homeowner insight using Teranet’s proprietary land title data. The solution enables mortgages and lending professionals to gather property-related intelligence online. Through PurView you’ll have access to ownership information, sales history, property value, mortgages registered on title, fraud flags, equity position and much more!

What is PurView?

PurView provides authoritative property, neighbourhood and homeowner insight using Teranet’s proprietary land title data. The solution enables mortgage and lending professionals to gather property-related intelligence online. Through PurView you’ll have access to ownership information, sales history, property value, mortgages registered on title, fraud flags, equity position and much more!

Why AVM Belongs in Your Valuation Services Mix

AVM technology isn’t a replacement for property appraisal, but it is here to stay. Whether or not you choose an AVM in any particular scenario depends on the nuance surrounding the property in question. There’s a continuum of choice and you have the power to pick the tools that will work best with each situation.

This series of insights will help you understand the valuation scenarios where an AVM is a best fit, the inherent differences in AVM data, and how to choose the right strategic partner to work alongside you throughout the lending lifecycle.

Why AVM Belongs in Your Valuation Services Mix

AVM technology isn’t a replacement for property appraisal, but it is here to stay. Whether or not you choose an AVM in any particular scenario depends on the nuance surrounding the property in question. There’s a continuum of choice and you have the power to pick the tools that will work best with each situation.

This series of insights will help you understand the valuation scenarios where an AVM is a best fit, the inherent differences in AVM data, and how to choose the right strategic partner to work alongside you throughout the lending lifecycle.

PurView Blog

Industry Insights from the PurView point of view

Filter

How can PurView help you?

Client Engagement Solutions

Gain automated access to key residential property data you can trust. These solutions offer you secure and timely valuations, property details and risk assessments that strengthen mortgage application completeness and underwriting processes.

Market Analytics Solutions

Access unique market data focusing on the dynamics of the Canadian housing market. Our Market Analytics solutions monitor price changes, trends in neighborhoods, market share and more; enabling you to stay ahead of the competition and changes in the market.

Portfolio Heath Solutions

Keep your existing portfolio on track with unparalleled insights into your business. We provide you with unique data that enables you to assess your risk exposure, measure market penetration and develop profitable campaigns for growth.

Risk Management Solutions

Manage your risk profile and compliance requirements with Risk Management solutions that give you greater control. Our deep-rooted understanding of the Canadian regulatory environment enables us to create solutions that help you mitigate risk.

How can PurView can help you?

Gain automated access to key residential property data you can trust. These solutions offer you secure and timely valuations, property details and risk assessments that strengthen mortgage application completeness and underwriting processes.

Access unique market data focusing on the dynamics of the Canadian housing market. Our Market Analytics solutions monitor price changes, trends in neighborhoods, market share and more; enabling you to stay ahead of the competition and changes in the market.

Keep your existing portfolio on track with unparalleled insights into your business. We provide you with unique data that enables you to assess your risk exposure, measure market penetration and develop profitable campaigns for growth.

Manage your risk profile and compliance requirements with Risk Management solutions that give you greater control. Our deep-rooted understanding of the Canadian regulatory environment enables us to create solutions that help you mitigate risk.

Subscribe to the Market Insight Report

The Teranet Market Insight Reports offer a comprehensive analysis and new insights focused on the real estate market. They include data compiled by Teranet’s data scientists and feature commentary from industry experts. Subscribe today to get these reports delivered to your inbox as soon as they’re published.

PurView partners with Canada’s largest and most trusted mortgage broker networks

PurView partners with Canada’s largest and most trusted mortgage broker networks

Bolster your property intelligence practices today!

Get a PurView Subscription

Complete our onboarding form and the PurView team will get in touch.