Lenders of all sizes understand the value of customer loyalty. In addition to helping you mitigate risk and lend with confidence, PurView’s proprietary property data helps lenders engage, qualify and grow customer relationships.

Our data creates opportunities to:

- Engage customers with market knowledge to become a trusted partner

- Qualify transactions with proper due diligence to mitigate your risk and ensure an efficient deal process

- Grow your customer relationships with valuable services that can create opportunities and provide peace of mind for your customers

PurView for Lenders

Lenders of all sizes understand the value of customer loyalty. In addition to helping you mitigate risk and lend with confidence, PurView’s proprietary property data helps lenders attract, engage, qualify and grow customer relationships. Our data creates opportunities to:

- Attract customers with meaningful market insight

- Engage customers with market knowledge to become a trusted partner

- Qualify transactions with proper due diligence to mitigate your risk and ensure an efficient deal process

- Grow your customer relationships with valuable services that can create opportunities and provide peace of mind for your customers

Benefits for Lenders

Lenders use PurView to help them lend with confidence and strengthen customer engagement.

Enhance Business Decisions

Quickly adapt to market fluctuations, justify lending decisions and strengthen underwriting processes with access to holistic property and ownership views, automated valuations and fraud checks that identify applications requiring further investigation.

Assess Market Data

Compare the valuation and sales history of similar properties in the neighbourhood to get a picture of real estate activity in the area.

Build Customer Relationships

Leverage individual property and broader market data to attract and engage your customers and ultimately strengthen your relationships.

Monitor Risk Exposure

Identify unusual title activity and inconsistent property values with customized risk scoring technology.

Lenders of all sizes and classifications use PurView.

Banks

Monoline Lenders / Mortgage Finance Companies

Credit Unions and Trust Companies

Mortgage Investment Corporations (MICs)

Private Lenders

Financing Companies

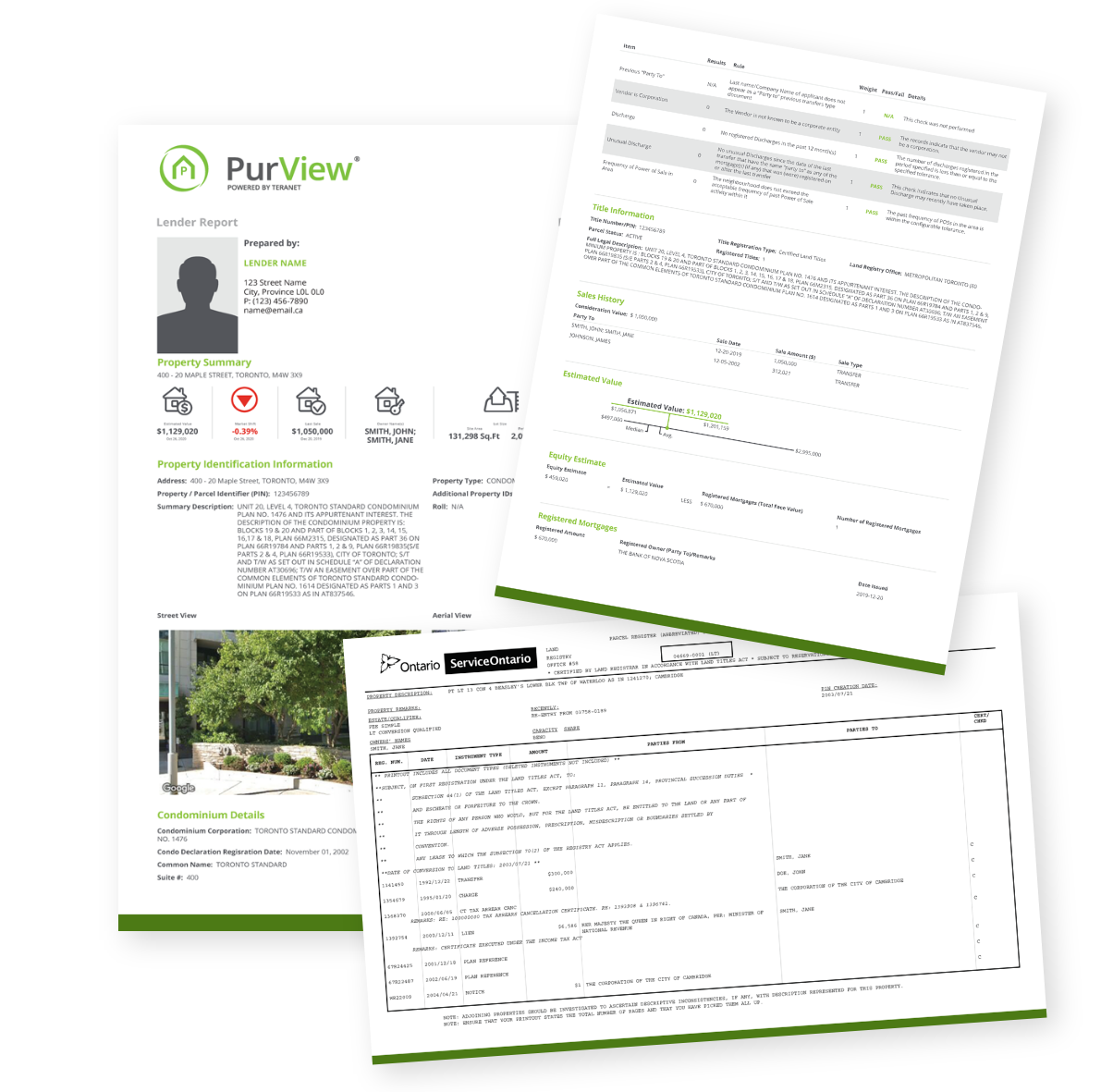

What do Lenders get from a PurView Report?

Quick and Accurate Valuations

Determine the value of the property with our leading Automated Valuation Model (AVM).

Verify Property Ownership

Validate registered owners on title.

Confirm Property Details

Visually inspect the property and surrounding area with aerial views.

Equity Estimates

Obtain an equity estimate on a home to confirm if your customers are eligible for new financing options.

Supplementary Searches

Dig deeper by ordering Parcel Registers and Instrument Images.

Frequently Asked Questions

What is a PurView Report?

The PurView Report is a real time estimate of the value of the subject property at a user specified date. In addition, the Report includes the property address, legal description, ownership and mortgage information, neighbourhood statistics, and comparable sales – all enhanced with street view and aerial imagery.

Does PurView have national coverage?

Our services are available across Canada: British Columbia, Alberta, Manitoba, Ontario, Quebec, Newfoundland, and Nova Scotia (Greater Halifax) with the exception of Fraud Check, which currently is only available in Ontario.

How quickly are reports available?

Reports are generated in real time and available instantly.

How do I log in to PurView?

You can log in to PurView by clicking the Login button on the PurView.ca homepage and entering your account credentials.

PurView Blog

Read our latest posts for Lenders

Bolster your property intelligence practices today!

Get a PurView Subscription

Complete our onboarding form and the PurView team will get in touch.